Unpacking Wirex: a user review

LeeKuanJew

LeeKuanJewI recently signed up to try Wirex, who describes itself as “a Crypto-friendly currency account”. Here, I look forward to giving an unbiased review of my experience, particularly in getting onboarded. Read along to find out if Wirex lived up to its hype.

Wirex: the real deal or a publicity stunt?

I must admit Wirex intrigued me with its value proposition. I have been looking for some time for a trustworthy provider of a digital account that is easy to set up and spend from. One of my hobbies and personal-growth interests is financial planning and personal finance, so naturally, I am wary of credit cards in general — I prefer savings to debt by a mile. Yet, it is hard to get by without a credit card, so I carry one against my better judgment. I say so because the whole experience of getting a credit card and maintaining it is an absolute hassle. My main interest is in saving, which I do in both fiat and Crypto. Unfortunately, I have been using different services to do handle my finances, as I had no other options where I live, or so I thought.

A Visa card with 19 currencies, both fiat and Crypto

“It is a real hassle to keep one’s Crypto and fiat holdings with different providers.”

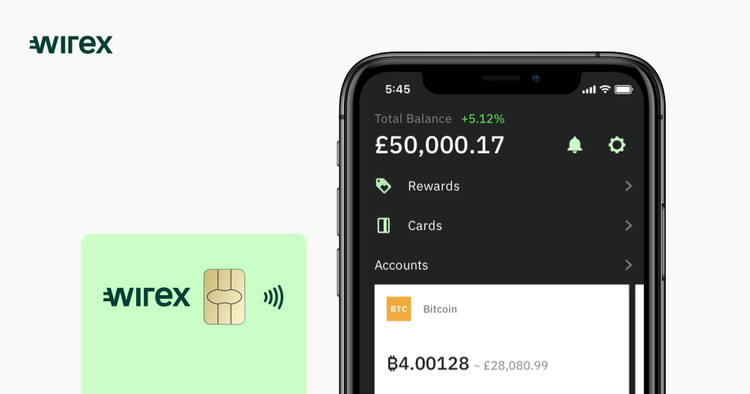

The problem is, of course, multifaceted. Let’s go with the scope of services first. Most Crypto wallet providers support a single protocol or a selection of cryptocurrencies. The best wallets integrate with fiat onboarding, but do not support fiat holdings. Then comes the problem of spending. It is a real hassle to keep one’s Crypto and fiat holdings with different providers. A multicurrency account is a plus in and of itself — now image an account with basically all the heavyweights of both the fiat and the Crypto world (fiat: USD, EUR, GBP, CAD, AUD, HKD, SGD, NZD, JPY, CHF, CZK, and even MXN; Crypto: BTC, ETH, LTC, XRP, XLM, DAI, NANO and native WXT). Let’s get real now. I buy the dip just as much as any HODLer, but I also cash out from time to time for personal investments or to buy nice things in the real world (isn’t that what we HODL for?). The sad reality is that fiat is much more widely accepted than Crypto today. In real life, the second-best alternative to carrying cash (highly not recommended) is having a widely accepted credit card. Wirex is accepted anywhere Visa is.

An account from a highly trusted jurisdiction

“To put it simply, the United Kingdom is the premier jurisdiction for financial services.”

The company itself is headquartered in the United Kingdom, and clearly displays on its website that they are regulated by the Financial Conduct Authority, the same authority that regulates British banks and financial institutions, including FinTech darlings like TransferWise and Revolut. More importantly, UK-regulated FinTechs cater to outside markets, unlike many US-based firms in the industry. To put it simply, the United Kingdom is the premier jurisdiction for financial services. Were that not enough, Wirex supports Asia–Pacific with a subsidiary in Singapore, the rising Asian world city and a big innovator in financial services and blockchain both.

Set up and on the way in 5 quick minutes

“Opening a bank account or getting a credit card has become a major headache in almost every country.”

Finally, the elephant in the room: Onboarding. Opening a bank account or getting a credit card has become a major headache in almost every country. Crypto onboarding, particularly in exchanges, is tangled in a web of regulations. Given the constant threat of sanctions by the government, users have come to expect a slow and complicated onboarding process, or fear they are being scammed if things look too lax. None of this helps Crypto go mainstream. Wirex offers a fast and relatively lean onboarding.

What’s a millennial to do when offered a quick application for a service that will store his fiat and his Crypto in a single application, plus provide a physical Visa debit card for spending? Naturally, give it a try.

The signup process

A quick search on Google for “Wirex” will lead you to the Wirex website which is beautifully done and very fast.

“Altogether, it took me 5 minutes to set up my Wirex account and 1 day to receive my Visa card.”

Once on their website, I was able to create the account right there and then. Wirex first asks about your country of residence, as they offer different services depending on whether you are in the European Economic Area, in Asia–Pacific, or elsewhere. I am in Asia–Pacific: in Hong Kong specifically. After registering with my email and a password, the verification process starts. I downloaded the iOS app, where verification was as simple as taking a picture of my Hong Kong identification card’s front and back, which detects glare and blurriness before confirming the submission. Wirex’s integration with Onfido was surprisingly quick, and my identity verification was approved in less than a minute. The next step was ordering the card, and for my region, I was able to enjoy free DHL Express courier service. Altogether, it took me 5 minutes to set up my Wirex account 1 day to receive my Visa card.

“... my identity verification was approved in less than a minute”

For top-up, in Asia—Pacific there is support for transferring Crypto in and using another credit card to deposit fiat. Once the card has money, one simply sets a priority for which currency will be used first (my card is set to HKD first, as I mostly spend my money in Hong Kong), which can be changed anytime with no hassles. There are other options like wire transfers (SEPA and SWIFT) for the rest of the world, but not at the moment in Asia—Pacific. I sincerely hope they sort this last hurdle soon and allow people in APAC to send money either locally, regionally, or all the way to the UK (easy with TransferWise, others) for a top-up. Actually, allowing top-ups with UnionPay credit and debit cards would also go a long way in APAC.

The fees for topping-up are phenomenal: 1% for crypto and free for fiat. Once inside the Wirex platform, there are no fees to spend money, to convert fiat-fiat (FX operations), or to transfer to another Wirex account. Withdrawal by ATM is free in the region until August 17. For exchanging Crypto, Wirex offers OTC rates, so very competitive. Support is by live chat, and also super fast and helpful.

Hacking life with Wirex

Since getting Wirex, I have ditched my local stored-value facility. Mostly, because Wirex offers a much better credit card. I had been struggling with getting my card rejected in a few places because my provider did not offer 3-D Secure authentication, which is the latest security technology in online transactions. Moreover, I had no physical card, which means that I was at the mercy of Apple Pay or some other middleware to use the card. Were that not enough, there was another concern which is fees. My old solution, like many credit cards, charged me a fee for foreign-transaction processing, which becomes very pervasive if, say, you live in cosmopolitan jurisdiction like I do where Uber, and a myriad of e-commerce businesses use their own payment processors, usually in USD.

An interesting feature of Wirex is their rewards program, which they call “ Cryptoback™”. This is essentially on-par with some of the best cashback incentives out there in traditional cards, paying up to 1.5% of in-store purchases back. The quirk is that they pay in BTC, which is a neat way to add to one’s BTC savings automatically. There is a catch: the more Wirex Token (WXT) you have in your account, the closer you get to that 1.5% in rewards.

Nowadays, not only do I enjoy a much more widely accepted card and significantly fewer fees, I can store my Crypto and fiat multicurrency savings securely in a UK-regulated institution.